Introduction to Pet Insurance

Pet insurance has emerged as a vital financial tool for pet owners, offering a safety net against unexpected veterinary expenses that can arise from accidents, illnesses, or chronic health conditions. As pet care costs continue to rise, the importance of having a comprehensive insurance policy in place has become increasingly evident. This type of insurance serves to alleviate financial burdens, allowing pet parents to focus more on their furry companions’ health rather than worrying about the escalating costs of care.

In recent years, the demand for pet insurance has surged, reflecting a broader trend towards responsible pet ownership. More individuals recognize that pets are not just animals; they are valued family members deserving of quality medical care. An insurance policy can provide peace of mind, ensuring that both preventative and emergency veterinary treatments are accessible without the stress of exorbitant out-of-pocket expenses. This assurance proves especially crucial as pets age or if they develop serious health issues, making regular medical visits more necessary and potentially costly.

For many, the prospect of a sudden veterinary emergency can be daunting, both emotionally and financially. Pet insurance can help mitigate these concerns, enabling pet owners to seek prompt medical attention without hesitation. Additionally, the variety of plans available in the market today means that there are options to suit different budgets and needs, whether one is looking for a basic level of coverage or a more comprehensive plan that includes wellness benefits. Thus, understanding pet insurance and its advantages is essential for all pet owners striving for their beloved animals’ well-being.

Want to Buy Pet Insurance Click Here

Why Choose Pet Insurance?

Pet insurance has become an essential consideration for pet owners, primarily due to the financial protections and peace of mind it provides. One of the key reasons to choose pet insurance is the overwhelming cost of veterinary care. As veterinary medicine advances, the cost of routine care and emergency services continues to rise. A sudden illness or injury can lead to expenses that are beyond the average pet owner’s budget, leaving many to make difficult decisions regarding their pet’s health. Having pet insurance mitigates these financial burdens, allowing pet owners to focus on their pet’s well-being rather than the cost of care.

Moreover, pet insurance enhances access to veterinary services. With a policy in place, pet owners are more inclined to seek timely veterinary attention without worrying about out-of-pocket expenses. Statistics show that insured pets are more likely to receive necessary medical treatments since their owners are more empowered to make decisions based on health needs rather than financial constraints. This proactive approach results in better health outcomes for pets and fosters a stronger bond between the pet and its owner, built on trust and shared care.

Testimonials from pet owners underscore the value of having pet insurance. Many pet parents report peace of mind knowing they can provide their companions with excellent care without facing crippling bills. Real-life stories highlight how insurance has allowed them to undertake surgeries, long-term treatments, and tests that they otherwise would have felt anxious about due to cost. These experiences emphasize the significant role that pet insurance plays not only in managing expenses but also in promoting healthier, happier lives for pets and their owners alike.

Want to Buy Pet Insurance Click Here

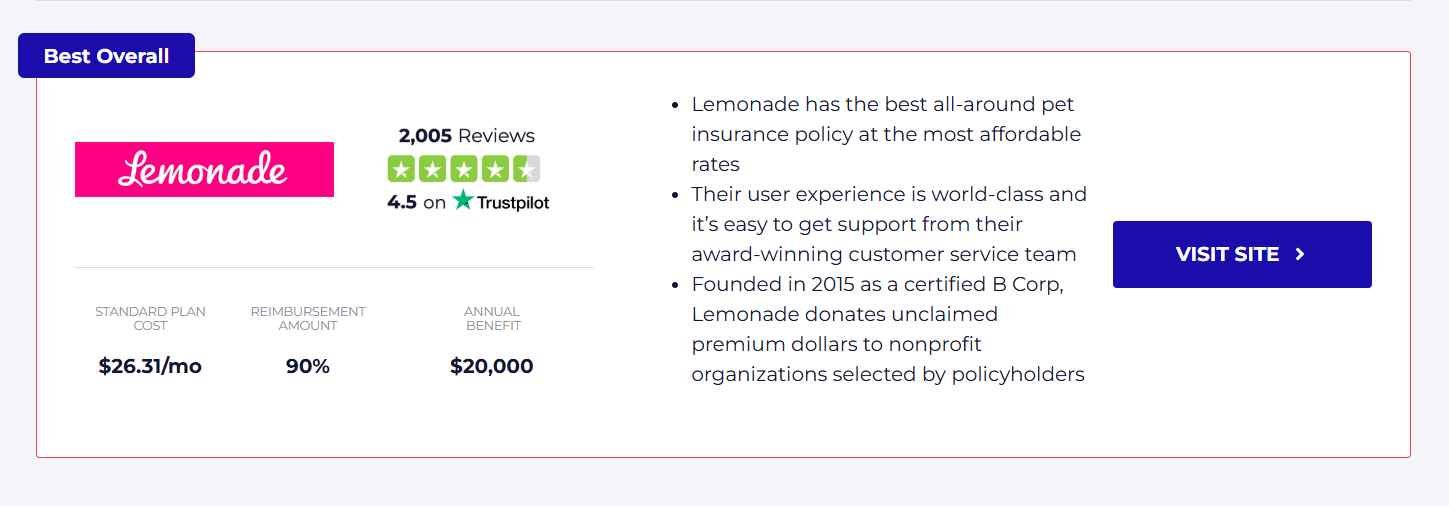

Lemonade: The Best All-Around Pet Insurance

Lemonade has emerged as a leader in pet insurance since its inception in 2020, offering a comprehensive suite of plans that cater effectively to various pet healthcare needs. The company distinguishes itself through a user-friendly online platform, allowing pet owners to easily select coverage options tailored to their budget and preference. Lemonade’s intuitive mobile application further enhances the user experience by enabling policy management, claims submission, and even customer support—all at the fingertips of pet parents. This focus on accessibility ensures that customers can navigate their insurance needs with ease.

One of the most notable features of Lemonade’s pet insurance is its transparent pricing model. The company employs a unique business model that emphasizes social responsibility. A portion of the premiums not claimed by policyholders is donated to charities chosen by Lemonade’s customers. This philanthropic approach not only contributes to various causes but also helps build a strong sense of community among policyholders. It becomes clear that Lemonade is not just driven by profit, but is also committed to making a positive impact on society.

{Hi I am Now struggling with unemployment, if you are interested to buy this insurance from the following Affiliate Link I will earn some commission amount it will be helpful to this Christmas to me, please support me, This is my Paypal Email id also stelladavidselvi@gmail.com} Happy Christmas and Happy New Year.

Customer service plays an integral role in the overall satisfaction of Lemonade’s clients. The company has garnered praise for its responsive and knowledgeable customer support team, which is accessible via chat, email, and phone. Lemonade has consistently received accolades for its commitment to service excellence, making it a go-to choice for pet owners seeking reliable insurance. Additionally, the brand’s innovative approach, transparency, and a strong focus on customer experience contribute significantly to its standing as the best all-around pet insurance provider in 2024. As pet ownership continues to rise, Lemonade remains at the forefront, efficiently meeting the evolving needs of pet caregivers.

Want to Buy Pet Insurance Click Here

Comparing the Best Pet Insurance Plans

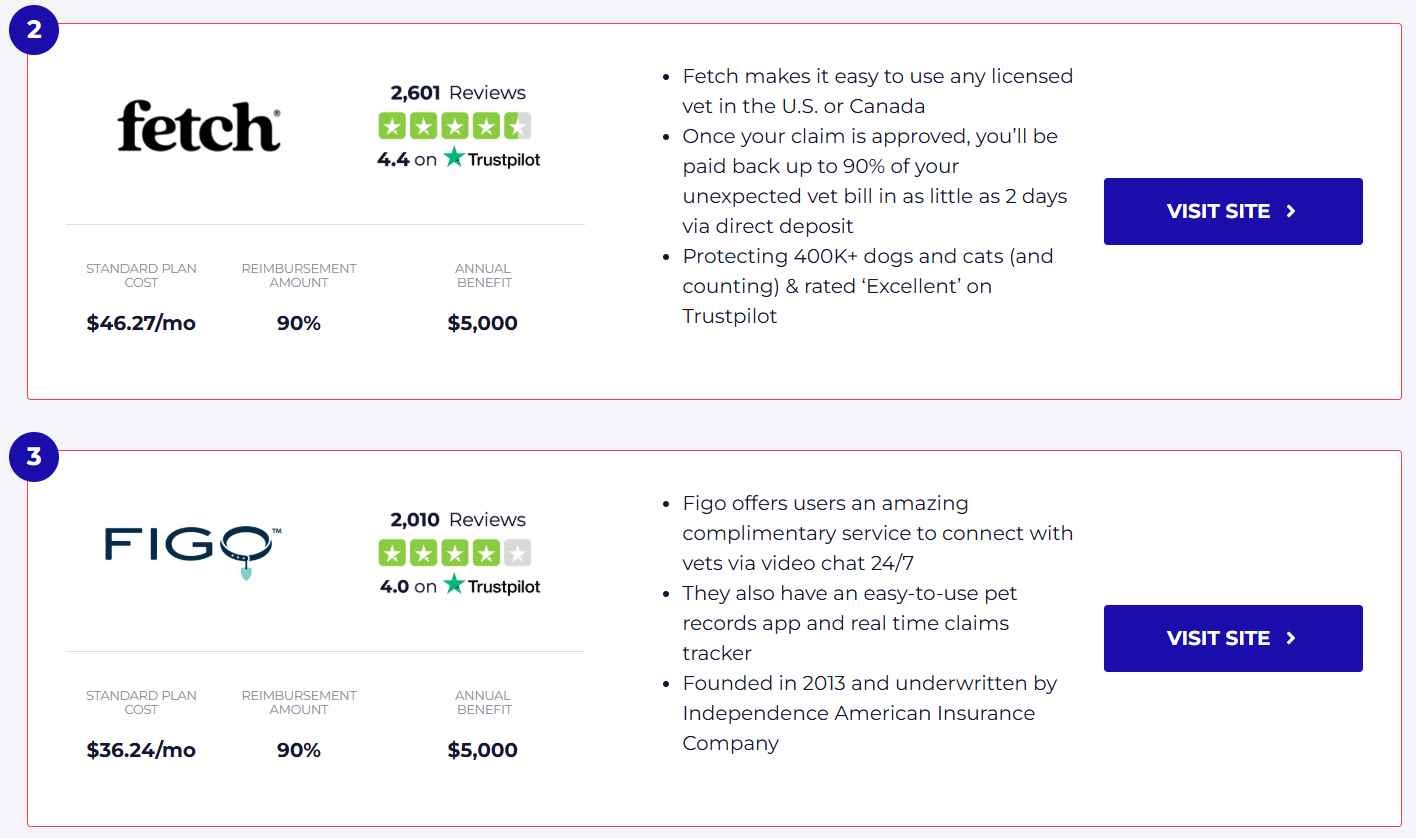

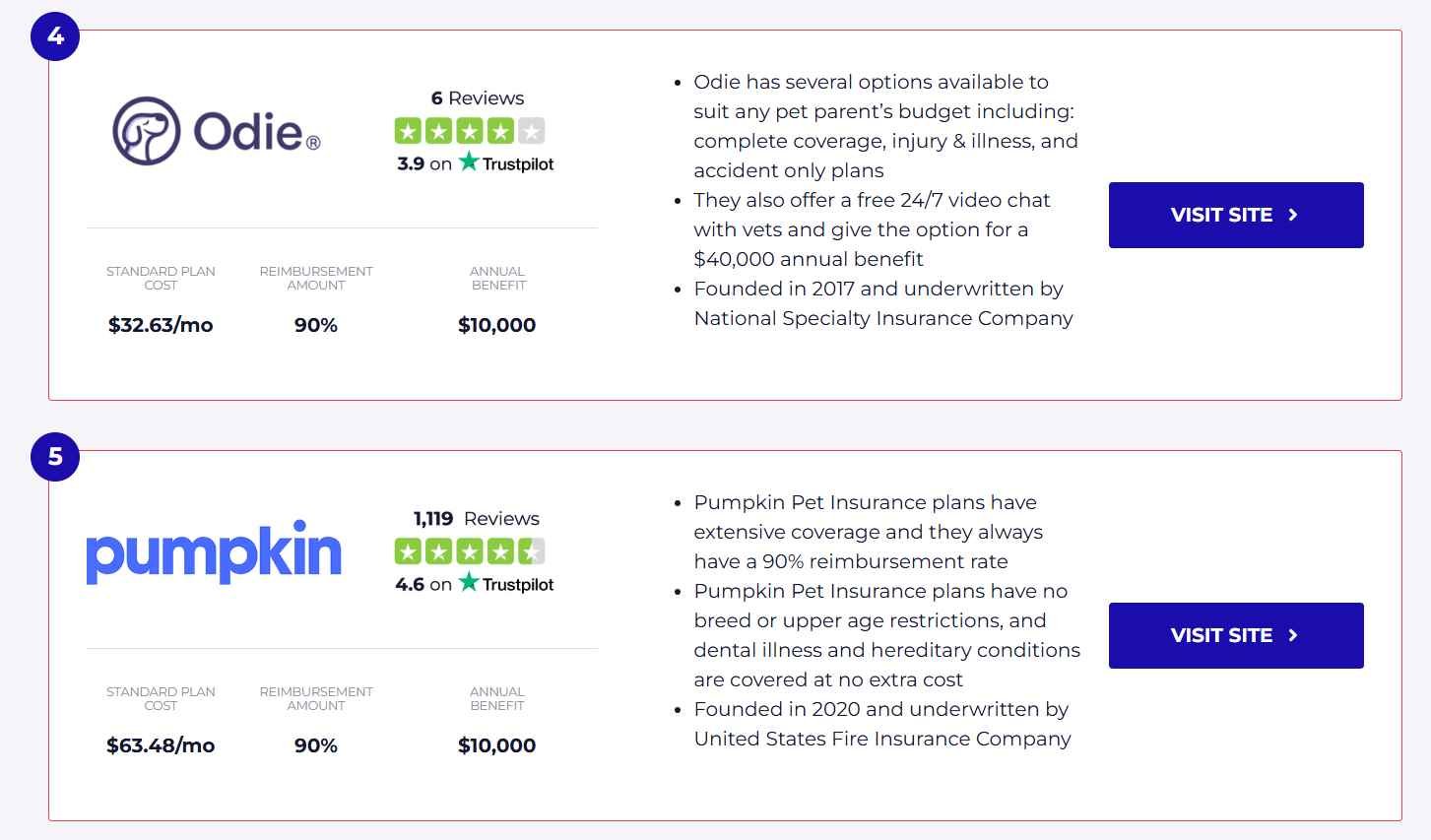

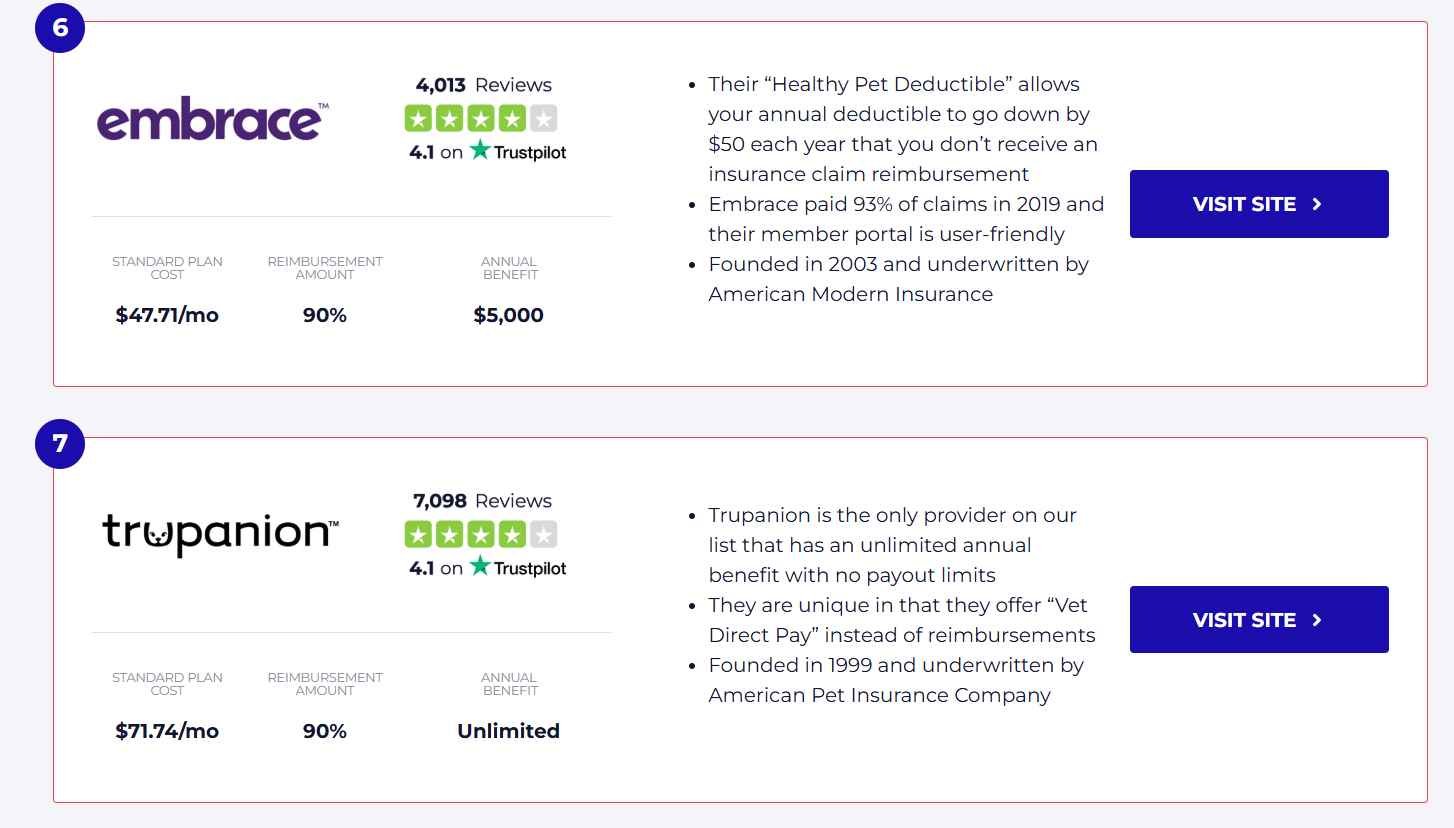

When selecting the most suitable pet insurance plan, it is essential to consider various factors that can impact both coverage and cost. In 2024, numerous companies offer a range of pet insurance options, but seven in particular stand out for their distinctive features and customer satisfaction: Lemonade, Fetch, Figo, Odie, Pumpkin, Embrace, and Trupanion. Each of these providers presents unique policies tailored to meet the specific needs of pet owners.

Lemonade has gained traction for its user-friendly digital platform and competitive pricing. The company’s plans often appeal to younger pet owners who appreciate the transparency in coverage and claims processes. Fetch offers extensive coverage for accidents and illnesses, making it a strong choice for those seeking comprehensive options.

Figo is known for its unique benefits, including a smartphone app that allows for easy claims tracking and direct communication with veterinarians. This tech-savvy approach enhances the overall customer experience, making it an appealing choice for busy pet parents. Meanwhile, Odie emphasizes a strong customer service focus, providing personalized support to pet owners, which can be a decisive factor for those new to pet insurance.

Pumpkin differentiates itself through the inclusion of wellness services in its policies, such as routine care coverage, which is often sought after by proactive pet owners. In contrast, Embrace stands out with its flexible coverage options, allowing pet parents to customize their plans based on their pets’ needs.

Lastly, Trupanion is renowned for its comprehensive approach to pet insurance, covering the majority of veterinary services with no payout limits, making it ideal for pets with ongoing health issues. By assessing these factors—coverage options, premium costs, and customer support—pet owners can make an informed decision when selecting an appropriate pet insurance plan that aligns with their requirements.

Want to Buy Pet Insurance Click Here

Cost of Dog and Cat Insurance by Breed

When considering pet insurance, it’s essential to understand how the breed of your dog or cat can significantly impact the cost of premiums. Different breeds have varying health risks and needs, translating into distinct insurance costs. This analysis utilizes the pricing from Lemonade Insurance to illustrate the average costs associated with the 15 most popular dog and cat breeds, offering valuable insights for prospective pet owners.

For instance, breeds such as French Bulldogs and Golden Retrievers are generally associated with higher insurance premiums. French Bulldogs often face respiratory issues, while Golden Retrievers are prone to certain genetic conditions such as hip dysplasia. Conversely, breeds like Beagles and Shih Tzus typically exhibit lower average costs due to their overall resilience and lower incidence of breed-specific health issues. Consequently, prospective pet owners should expect variations in insurance costs ranging from $30 to $100 per month, contingent upon the dog or cat’s breed.

Age is another factor that plays a critical role in determining insurance costs. Younger pets often attract lower premiums due to their reduced risk of illness and accidents. As pets age, their likelihood of requiring medical care increases, which can, in turn, lead to higher premiums. Health history is equally significant; a pet with pre-existing conditions may see elevated costs or may be ineligible for coverage altogether. Additionally, geographic location factors in as well, as areas with a higher cost of living may have elevated veterinary care costs, influencing the price of pet insurance.

Ultimately, understanding the correlations between breed, age, health status, and geographical location is critical for pet owners seeking the right insurance plan. By analyzing these elements, owners can make informed decisions that best align with their budget and their pets’ needs, ensuring adequate coverage tailored to their specific situations.

Want to Buy Pet Insurance Click Here

Understanding Insurance Costs: Breakdown by Factors

When evaluating pet insurance costs, several key factors come into play that influence the overall premium amount. Understanding these aspects can aid pet parents in making informed decisions regarding their insurance needs. Primarily, the breed of the pet significantly affects insurance costs. Certain breeds are predisposed to specific health issues, and insurers consider these risks when determining premiums. For instance, breeds known to suffer from genetic disorders may incur higher insurance costs, as the likelihood of expensive medical care increases.

Location is another crucial factor impacting pet insurance rates. Premiums can vary significantly based on the region. Urban areas typically exhibit higher costs for veterinary services, which can lead to increased insurance premiums. Conversely, rural locations might have lower rates due to a more economical cost of living and veterinary practices. Pet parents should research local veterinary practice costs and how they might affect insurance premiums within their area.

The age of the pet is a critical element as well. Generally, younger animals can secure lower insurance premiums due to their lower likelihood of serious health issues. As pets age, the risk of developing chronic conditions grows, resulting in elevated insurance costs. Furthermore, pre-existing health conditions are pivotal in shaping insurance premiums. Many pet insurance providers require thorough medical history assessments, and pets with ongoing health issues may face higher premiums or might be denied coverage altogether.

Finally, pet owners can estimate their insurance costs more accurately by considering these factors alongside the coverage options offered. Comparing policies with varying deductibles, co-pays, and coverage limits can provide insights into affordable solutions that cater to specific needs. By analyzing these elements holistically, pet parents can better navigate their pet insurance journey.

Want to Buy Pet Insurance Click Here

Real-Life Impact of Pet Insurance

Pet insurance has become a valuable resource for many pet owners, providing peace of mind and financial backing during challenging times. Numerous testimonials reveal how having pet insurance has significantly impacted the lives of both pets and their families. Many pet parents recount experiences where insurance coverage enabled them to make swift decisions during emergencies, thereby ensuring optimal health for their beloved companions.

For instance, one pet owner shared her experience when her Labrador retriever unexpectedly fell ill. After an urgent visit to the veterinarian, she learned that surgery was required, costing thousands of dollars. Thanks to her pet insurance policy, she was able to cover a considerable portion of the expenses. “If I didn’t have insurance,” she explained, “I would have faced an impossible decision between my dog’s health and my finances. Instead, I was able to focus on what mattered most—helping my pet recover.” This story showcases how pet insurance can alleviate financial stress, allowing owners to pursue necessary medical interventions without hesitation.

Another testimonial highlights the importance of preventive care covered by insurance. A cat owner noted that her policy included wellness visits, vaccinations, and routine check-ups, which helped her spot potential health issues early on. “With the insurance, I’ve been more proactive with my cat’s health care. Not only does it cover unexpected emergencies, but it also encourages us to maintain regular veterinary visits,” she stated. This emphasis on preventive care reveals that while emergencies can arise, pet insurance promotes the overall well-being of pets by making regular care more accessible.

As these stories illustrate, the real-life impact of pet insurance is profound, aiding pet parents in providing comprehensive care for their furry companions and ensuring that financial concerns do not overshadow the well-being of their pets.

Want to Buy Pet Insurance Click Here

How to Choose the Right Pet Insurance Plan

Choosing the right pet insurance plan is a crucial decision for pet owners that requires careful consideration of various factors. First and foremost, it is essential to assess your pet’s unique needs, including their age, breed, and any pre-existing conditions that may affect their health. Young and healthy pets may benefit from basic insurance plans, while older pets or those with chronic illnesses may need more comprehensive coverage that includes specialized treatments.

When evaluating pet insurance options, it is imperative to look for necessary coverage choices. Key elements to consider include accident and illness coverage, hereditary condition coverage, routine wellness care, and the provision for emergency services. Pet insurance plans can differ significantly in these areas, so understanding what each policy entails is vital. Additionally, consider whether the plan includes a annual limits on payouts, which can directly influence the financial assistance available during a health crisis.

Another important aspect is comparing multiple providers. It is wise to obtain quotes from different insurance companies and analyze their offerings, premiums, deductibles, and co-payments. Reading through customer reviews can also provide insights into how well each provider handles claims and customer service interactions. Some providers may offer additional perks such as telehealth services, which can add value to the insurance experience.

Ultimately, making an informed decision when selecting a pet insurance plan involves weighing the different elements of coverage, costs, and provider reputation. By considering your pet’s specific needs, choosing the right options, and comparing multiple plans, you can ensure that you select the most suitable insurance coverage that provides peace of mind and financial protection in times of need.

Want to Buy Pet Insurance Click Here

Conclusion

In the ever-evolving landscape of pet care, the significance of pet insurance cannot be overstated. As discussed throughout this guide, a reliable pet insurance policy can act as a financial safety net for unexpected veterinary expenses, ensuring that pet owners are not left to decide between their beloved pet’s health and their personal finances. The need for comprehensive coverage is paramount, as it allows pet parents to pursue the best possible veterinary care without the overwhelming concern of mounting bills.

Throughout this exploration of pet insurance options, we highlighted several critical factors that prospective policyholders must consider, including coverage types, deductibles, reimbursement rates, and exclusions. Each insurance provider offers a range of plans tailored to different needs and budgets. Therefore, it is essential for pet owners to carefully evaluate the specifics of each policy before making a decision.

Furthermore, the importance of conducting thorough research cannot be emphasized enough. This includes reading customer reviews, comparing multiple providers, and understanding the various terms and conditions associated with the policies. Such diligence not only aids in selecting the most suitable insurance but also fosters peace of mind, knowing that pet owners are well-prepared for any potential health issues that may arise. In conclusion, investing in pet insurance is a proactive step towards ensuring the well-being of your furry family members while also providing financial security during times of need. Taking the time to make an informed decision now can have significant positive impacts on the health and happiness of pets in the future.

Also You are like this Article: Unlock the Secrets of Perfect Pet Training: Easy, Efficient, and Fast Method!

Train your pets with full of confidence with this E Book Click Here

For more Articles Click Here

Want to Buy Pet Insurance Click Here

Happy Christmas And Happy New Year Friends and Family’s, Thanks for reading